Cosmetics-perfumery in Paris Region, a worldwide leader ecosystem faced with bitter competition

France is number one worldwide in the cosmetics-perfumery industry, and Paris Region (Ile-de-France) the site of its leaders. From international headquarters to research centers, the entire value chain is present in it. The dominant position of the region ecosystem is however not secure.

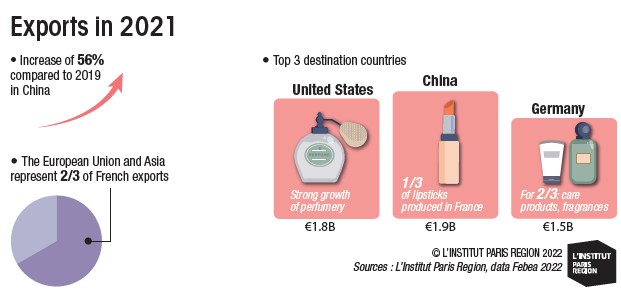

If the French trade deficit continues to worsen for most manufactured products, the cosmetics-perfumery industry is an exception: its exports were worth 16.2 billion euros in 2021, making up for the decline in 2020 and exceeding the 2019 level by 2.5%. France has consequently pulled largely ahead of the United States, number two, whose exports were 9 billion euros in 2020. The sector however must become more organized to keep its leadership faced with the rise of Asian competitors, and the strong societal demand for products that are not only efficacious, traceable and innovative, but also without any harmful effects on health and the environment.

PARIS REGION, THE EXPORT CHAMPION

Some 80% of French production is exported. The first destination country is China, with 1.9 billion euros (11.7% of exports), followed by the United States, with 1.8 billion euros, (11.2% of exports), then Germany, with 1.5 billion euros (9.5% of exports). Buoyed by 246,000 employees and 3,200 companies in France, cosmetics-perfumery is consequently the third contributor to the country’s trade surplus: its positive balance is 12.9 billion euros, after aeronautics and wine and spirits. This very favorable situation nonetheless is not secure.

China, which is an increasingly important market for French industry (exports leapt by 56% in 2021, compared to 2019), now imposes restrictive conditions on exporters and is heavily assisting its own cosmetics industry. South Korea is doing likewise, with policies on the national scale but also those that favor the development of an international cluster in the Seoul region.

IN SEOUL, A FUTURE COMPETITIVE CLUSTER FOR THE BEAUTY INDUSTRY

Seoul’s metropolitan government announced, in April 2022, its plan to create a “Global Beauty Industry Hub.” The strategy consists in making the Korean contents of the beauty industry (extended to fashion and design) converge with those of pop music and cinema, to make it a source of tourist attractivity. The cluster will be installed in Seoul’s tourist district, around the Dongdaemun Design Plaza (DDP), a work designed by the renowned architect Zaha Hadid, an immense complex that opened in 2014. It is a temple of design, equipped with a convention center and an entertainment hub. Substantial financial resources have been announced, between the creation of a fund dedicated to the beauty industry of 168 million euros for the 2022-2027 period and tax reductions, accompanied by a policy aiming at attracting foreign capital but also supporting the development of Korean companies.

Aware of the competitiveness stakes, Paris Region has deemed this sector “strategic” in its 2022-2028 Regional Economic, Innovation and Internationalization Plan (SREDII), approved on May 19 by the Regional Council. This ambition reflects the economic weight of this sector in Paris Region.

THE REGION, A DECISION-MAKING CENTER IN WHICH THE COSMETICS-PERFUMERY INDUSTRY OF TOMORROW IS BEING CREATED

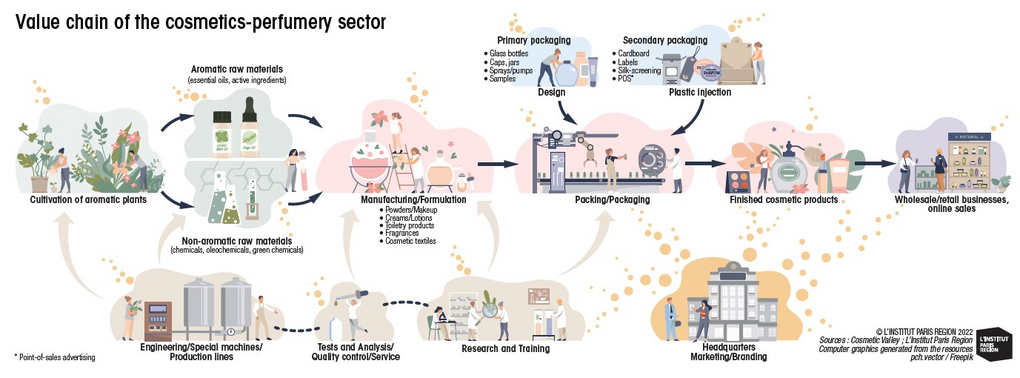

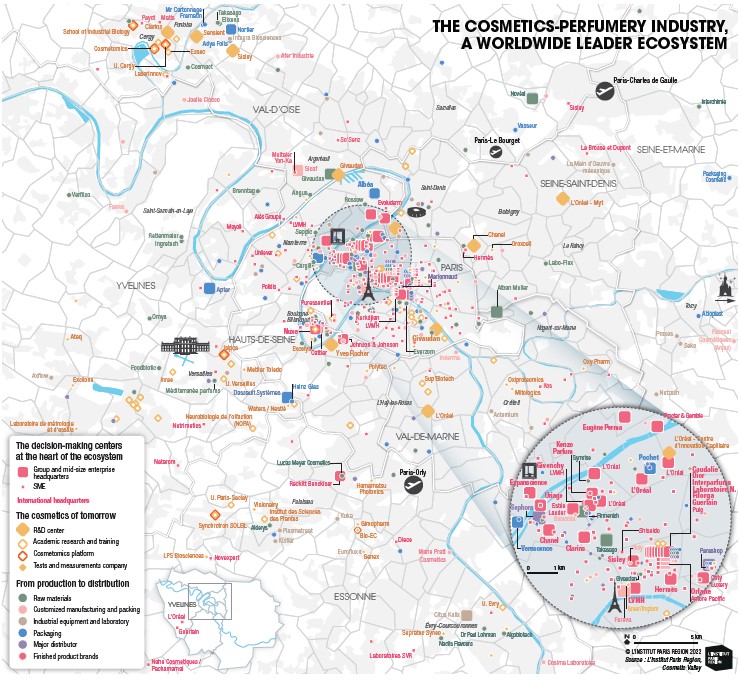

Apart from stores, there are over 800 companies in the sector in Paris Region, in which the entire value chain is represented: the brands, their headquarters, as well as their research and development (R&D) laboratories, of course; but also the companies that produce the raw materials; firms that do customized manufacturing, formulation and packing; those that make packaging, in particular, primary packaging (bottles, caps and jars, so important for these products); industrial equipmentmakers; and finally, testing and analysis laboratories.

The Paris Region ecosystem concentrates the sector’s headquarters (international and European and Middle Eastern head offices) of large groups and mid-size enterprises. This is the case for French groups, but also for many foreign groups when they decide to locate in France to benefit from the wealth of its ecosystem, like Puig, a Catalan group bringing together among others Paco Rabanne, Nina Ricci and Jean-Paul Gaultier. A dozen or so international headquarters are in Hauts-de-Seine, such as Expanscience-Mustela and Verescence in La Défense, Chanel, Sephora and Uriage in Neuilly-sur- Seine and L’Oréal and Pochet in Clichy. There are just as many, even more, in Paris, with Coty Luxury, Clarins and Hermès, and in particular in the 8th arrondissement where Caudalie, Dior, Guerlain, Interparfums, Laboratoire Native, LVMH and Sisley are located.

Alongside these companies with an international reputation, the sector has a plethora of brands, some of them artisanal, about 300 in all, nearly two thirds of which are in Paris. The niche markets are, moreover, extremely promising, and several of its representatives are found on the rue des Francs- Bourgeois, in the 4th arrondissement of Paris. It is therefore in Paris Region that the major decisions of the sector are made. It is also in the region that the cosmetics-perfumery industry of tomorrow is being created.

GREAT POTENTIAL IN R&D AND IN TESTS AND MEASUREMENTS

The strength of academic research in Paris Region is a reality whatever the scientific field concerned, but it is particularly renowned for healthcare industries, certain areas of which converge with those of the cosmetics-perfumery sector. The future of the French sector is played, in particular, in the quality of the products made in France: the tests and measurements activity associated with research is therefore essential. The principal research laboratories in the field are located in Paris-Saclay and Cergy-Pontoise. This territory is also home to the Cosmetomics platform, whose objective is to bring together all the expertise in measurements for the cosmetics sector. It is a pooled platform on which the SOLEIL synchrotron (a particle accelerator, a facility unique in France, located in Paris-Saclay), BIO-EC (an SME specialized in efficacity studies on cosmetic and dermatological products, in Longjumeau) and the School of Industrial Biology, in Cergy, collaborate.

The SOLEIL synchrotron makes it possible to better analyze the expected effect of a cosmetic product by following in an infinitely more precise way the trajectory of the active ingredients. The migration of nanoparticles, abundantly used in cosmetics products for their power to create a matte finish, act as an anti-UV rays filter and their capacity to stabilize an emulsion or maintain particles in suspension (called rheological agents), can now be followed in different compartments of the skin or a strand of hair. The SOLEIL synchrotron can also evaluate their efficacy and innocuousness.

A CONCENTRATION OF R&D CENTERS

If the companies call on the capacities of public research and its facilities, as the Cosmetomics platform illustrates, the largest enterprises also have their own R&D capacities.

Paris Region ecosystem brings together nine major R&D centers: four in Val-d’Oise (that of Clarins in Pontoise, that of Givaudan in Argenteuil and those of Sisley and Sensient in Saint-Ouen-l’Aumône), three in Seine-Saint-Denis (that of Chanel in Pantin and two of the three international research centers of L’Oréal: the international capillary innovation center, in Saint-Ouen, and the international advanced research center, in Aulnay-sous-Bois). The third, in Chevilly-Larue, is its international center for research applied to cosmetics. The Yves Rocher research center is located in Issy-les-Moulineaux.

A MAJOR SCENT CREATION CENTER: GIVAUDAN IN ARGENTEUIL

The Givaudan site, in Argenteuil (Val-d’Oise), extends over 6 hectares along the Seine and has 600 employees. This Swiss company, little known by the general public, is a world leader of the flavors and fragrances industry. Positioned upstream of the value chain, with the production of synthetic raw materials, Givaudan also files patents and has created one scent out of four marketed in the world, whether this concerns perfumery or functional fragrances (detergents, household products, etc.). At the creation center in Argenteuil, the group’s largest center worldwide, all sorts of scented compositions for mass market products are created. As for processes, only one hour is needed between the perfumer’s proposal and the fabrication of the sample: a robot carries out 60 to 70% of the mixtures, laboratory personnel complete it immediately afterward and the perfumer can very quickly do the olfactory test, a step that is indispensable before the tests of mixtures between the base and the fragrance. Lastly, post-washing tests are conducted if this concerns products for laundry, or post-shower tests for body or hair products. Perfumers and evaluators work together, making the proposal evolve until it is presented to the client, who then adopts it. The choice of Paris Region is historic for this Swiss company, which has made major investments for several years in its Argenteuil site, as well as in its Paris headquarters, on the avenue Kléber, in the 16th arrondissement. It is moreover not the only company to develop its industrial capacities in Val-d’Oise.

“From Argenteuil, we serve the whole world.” Antoine Sauvan, human resources director and president of Givaudan France

THE STRENGTH OF A COMPLETE VALUE CHAIN

In Paris Region, the brands can, at any moment, rely on the many enterprises covering the entire value chain. There are more companies in customized manufacturing and packing, over 35 that supply industrial equipment and laboratories, more than 80 specialized in raw materials, over 40 for tests and analyses, 70 in primary and secondary packaging and lastly a very large number of distributors. The region proposes a complete ecosystem in which everything is brought together so that fragrances and cosmetics are designed, produced, then distributed around the world.

Several companies located in the region illustrate this economic power. The Sicaf company, part of the Anjac group, in Argenteuil, develops tailormade products for different brands, such as Decléor and Filorga, present in Île-de-France. In Savigny-le-Temple, Cosmeva, of the Fareva group, one of the world leaders in industrial outsourcing, manufactures and packages for cosmetics brands – therefore its clients – products (in bottle, tub and stick form), in a broad range of galenic forms: emulsions, powders, etc. Sensient, with its R&D center in Saint-Ouen l’Aumône, is notably specialized in making coloring agents for the cosmetics and pharmaceutical industry.

It is also in this commune of the Cergy-Pontoise conurbation that MR Cartonnage numérique, a Paris Region SME founded in 2009, that benefitted from the support of BPI (the French public investment bank) installed its factory. This firm illustrates the characteristics of the Paris Region ecosystem.

Located in one of the region’s main cosmetics territories, it designs and produces luxury cardboard packaging for many brands. These brands know that they can find in this supplier, the expected service level, in a necessary geographic proximity, especially in the product definition phase. It is the assurance of solidity and agility for this manufacturer that, moreover, is not dependent on a too small number of clients.

Paris Region has a complete and solid ecosystem, which includes large groups but in which new entrants and startups can also grow.

Certain territories have acquired a form of specialization, like that of Cergy-Pontoise and the Boucle Nord de Seine. They furthermore have land or real estate capacities to house potential extensions of production units.

DOUBLING OF THE SISLEY CENTER’S CAPACITY IN SAINT-OUEN L’AUMÔNE

Sisley is enlarging and modernizing its site in order to welcome, not 400 but 700 employees by 2030. The opening of the new 17,000 m² campus is planned for 2024. The investments in the site – 40 million euros have been announced – aim at modernizing its international logistics platform, from which the products manufactured in its Blois plant, and whose capacities must also be doubled, are shipped throughout the world (in particular to the United States and China).

But Sisley’s future, like that of many other companies in the sector, is in the development of innovative cosmetics and new brands, hence the investments to increase R&D capacities, and the announced recruitment of researchers and engineers.

AN ECOSYSTEM EQUAL TO THE CHALLENGES OF TOMORROW

The sector’s actors are aware that their lead can only be maintained provided that they act, and especially in such a way that French products are always classified the best in the quality indicators, whether these indicators are drawn up by China, the United States or France, because what is important is to be the driving force on this subject. To assert its leadership, the profession is reflecting on producing its own indicators as well as information that is an assurance of reliability on four tracks. These were shared during the 2022 summit of the French perfumery-cosmetics sector: the authenticity of the ingredients (total transparency), the performance of innovation (strong and collaborative R&D, carried out with public and private partners), consumer safety (total obligation of control of information and claims) and, lastly, the protection of the environment.

“It is the gateway to be a leader tomorrow with a local client that will choose a product made in France, because that will mean authenticity, performance, protection and safety.” Marc-Antoine Jamet, president of Cosmetic Valley

ARTIFICIAL INTELLIGENCE (AI) SERVING NOSES

As in every industry, AI is rolled out in cosmetics-perfumery, from the creation to the distribution phase. In an unexpected way, perhaps, this sector uses AI right from the creation phase for its scents.

Consequently, Givaudan uses AI as an aid to its perfumers’ creativity. The knowledge of its clients, consumers’ expectations, the extent of the collections created, the presence of flagship products… all these elements supply major databases. They are integrated into a tool that must permit the perfumers to extend the choice of possibilities and accompany them in the products’ formulation. They can then very quickly test the juice that was created.

New AI tools are also undergoing reflection to propose customization to the end customer, a personalized cosmetics offering: help in looking for an appropriate treatment, care products created taking into account the skin’s condition at a precise moment, personalized aromas depending on tastes… In the same way as cosmetics have been identified as a strategic sector for the economic development of Paris Region, AI has been recognized as a “strategic technology.” These two recognitions should make their fruitful association possible.

The region has all the advantages to enable the profession to take the necessary directions. Reflections could be started to make the strategies of international spread and influence of the cosmetics-perfumery industry converge with those of the creative, cultural and tourist industries: a path to explore to maintain the leadership of Paris Region and its sectors in the battle being waged in the world’s large metropolitan regions.■

This study is linked to the following theme :

Economy